Bitcoin ignores new ‘OG’ whale selling as BTC price hits $113K

Cointelegraph

Aug 28, 2025 17:30:10

Key points:

Bitcoin builds on 1.6% daily gains as bulls overcome a fresh round of BTC sales by an “OG” whale entity.

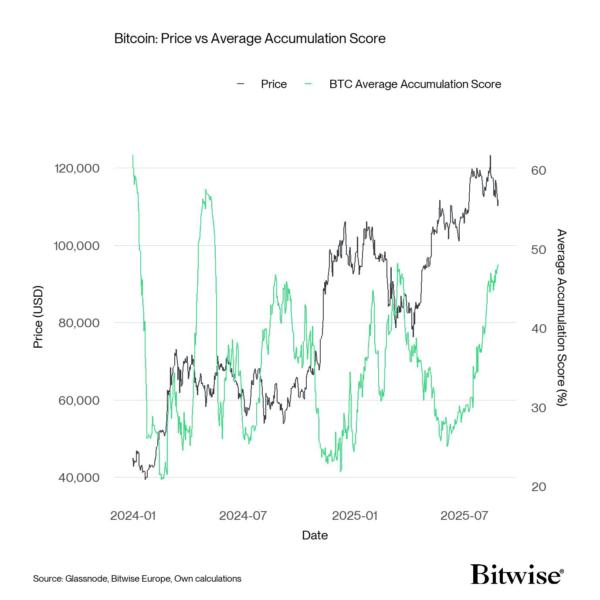

Accumulation is in full swing across the board, research says, with interest mimicking April’s price rebound.

BTC price action needs to avoid a “double top” all-time high next.

Bitcoin broke above $113,000 on Thursday as demand from Asia ignored fresh whale selling.

Bitcoin whale sales fail to drive BTC lower

Data from Cointelegraph Markets Pro and TradingView showed gaining 1.6% on the day to hit highs of $113,365.

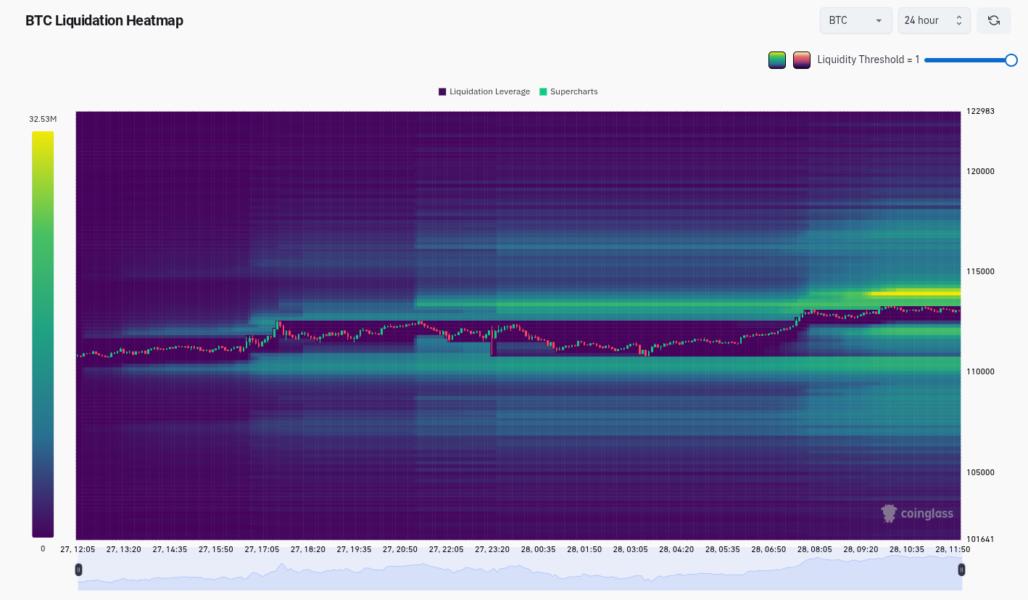

The uptick liquidated about $40 million of crypto shorts in the four hours to the time of writing, per data from CoinGlass, with BTC resistance stacked overhead.

At the same time, a Bitcoin “OG” whale began to distribute more of their supply, with 250 BTC ($28.2 million) sent to crypto exchange Binance. The transaction was noted by X analytics account Lookonchain, and followed a 750 BTC sale the day prior.

Whale distribution behavior, often involving coins dormant for a decade or more, previously sparked a snap BTC price downside.

Bitcoin OG "bc1qlf" just deposited another 250 $BTC($28.29M) to #Binance, with 3,000 $BTC($339M) left.https://t.co/92XAZMJQsp pic.twitter.com/fAugznA7gL

Commenting on the recent selling trend among whales, longtime market analyst Peter Brandt argued that it reflected classic “market tops.”

“It represented SUPPLY. Tops in markets are created by SUPPLY or DISTRIBUTION,” he wrote in part of an X post on Wednesday.

As Cointelegraph reported, not all classes of Bitcoin investor have rethought their market exposure.

As noted by Andre Dragosch, European head of research at crypto asset manager Bitwise, both retail and institutional accumulation are now at their highest since April, during the aftermath of a dip to local lows under $75,000.

“Such high level of accumulation tends to precede major breakouts to the upside,” Dragosch concluded alongside Bitwise data.

Trader: Bitcoin “double top” risk remains

Meanwhile, Brandt remained level-headed on the outlook, saying that needed to reclaim $117,500 to invalidate bearish trend reversal signals.

Failure to do so, he said, would leave recent all-time highs as a “double top” formation, discounting seven weeks of price action.

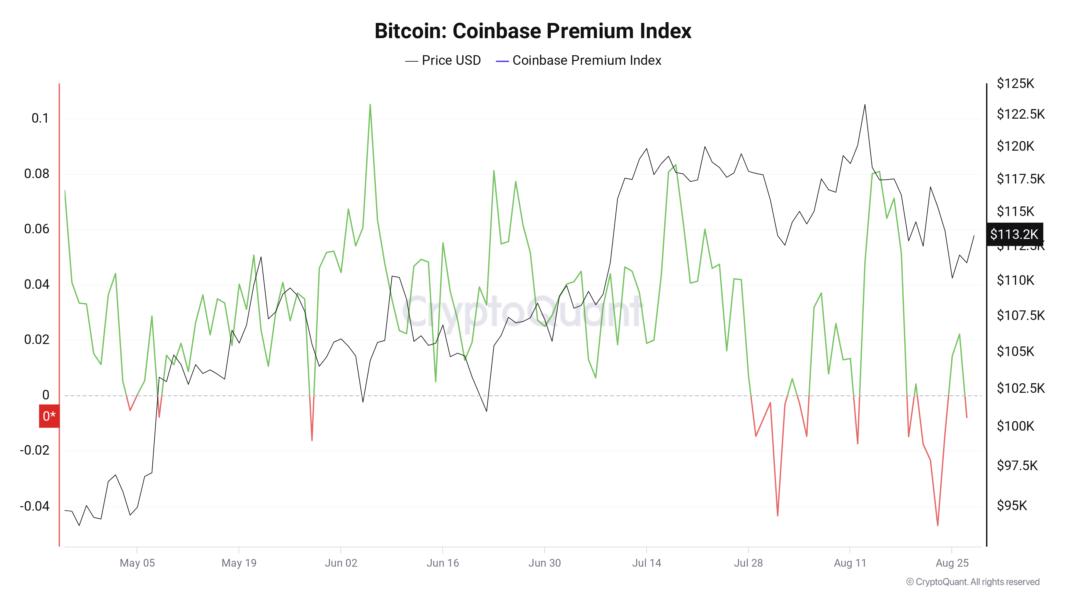

A warning signal from the Coinbase Premium Index ahead of the Wall Street open showed that Bitcoin bulls were not yet in the clear.

The Premium was red for Wednesday, per data from onchain analytics platform CryptoQuant, pointing to weakening US demand after a strong start to the week.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Latest News

ZyCrypto

Aug 29, 2025 04:29:55

Dow Jones Newswires

Aug 29, 2025 04:13:00

Cointelegraph

Aug 29, 2025 04:03:57

Cointelegraph

Aug 29, 2025 04:03:57

Cointelegraph

Aug 29, 2025 03:52:48