Bitcoin at risk of further decline amid leverage peak and ‘huge’ Ethereum rotation: analyst

The Block

Aug 27, 2025 20:18:46

Bitcoin's recent price weakness may not be over yet, according to K33, with a leverage surge and significant rotations into Ethereum leaving the foremost cryptocurrency vulnerable to further downside in the near term.

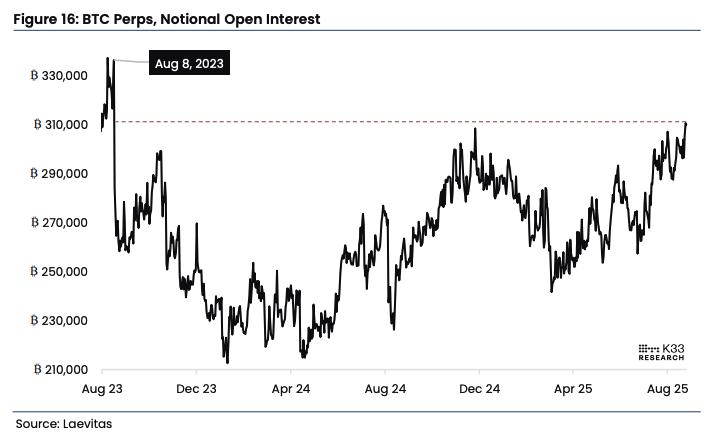

Notional open interest in bitcoin perpetual futures has surged to a two-year high of over 310,000 BTC ($34 billion) — up 41,607 BTC in the last two months alone — with a sharp weekend acceleration of 13,472 BTC marking a potential inflection point, K33 Head of Research Vetle Lunde said in a Tuesday report. The spike, paired with a jump in annualized funding rates from 3% to nearly 11%, signals increasingly aggressive long positioning at a time of relative price stagnation, he explained.

According to Lunde, the conditions resemble leverage build-ups seen in the summers of 2023 and 2024, both of which ended with sharp liquidation cascades in August. This time, however, the OI peak has arrived later in the month, suggesting a more drawn-out consolidation regime — one that might catch dip buyers offside. "The risks of long squeezes in the near term are elevated," he warned, adding that conservative positioning may be prudent until the market clears the excess leverage.

BTC perps notional open interest. Image: K33.

'Huge' rotation to ETH

Adding to the volatility is a "huge" rotation by a long-term holder, who swapped 22,400 BTC for ETH via decentralized exchange Hyperunit last week, Lunde noted. The whale's move helped push ETH to a new all-time high of $4,956 over the weekend, ending a 1,380-day drawdown and flipping market momentum toward Ethereum, he said.

The ETH/BTC ratio also surged above 0.04 for the first time in 2025, underscoring the relative strength in Ethereum at present. However, despite ETH's USD rally, its longer-term relative trend against BTC remains weak — with 1-, 2-, and 3-year rolling ETH/BTC returns still in negative territory, Lunde noted.

Historically, ETH all-time highs have often marked broader crypto tops, with past cycles in 2017 and 2021 showing similar sequences: ETH breaks out, altcoins rip, and BTC stagnates amid waning demand — fueling concerns that the current crypto bull market is too nearing its end.

However, compared to sub-40% levels during prior peaks, BTC dominance remains elevated at 58.6%. "Thus, while the relationship between former ETH ATHs and BTC is concerning, we've yet to reach a situation that significantly points toward broad altcoin froth," Lunde said.

Meanwhile, institutional flows continue to show a cautious tilt. CME traders have pared BTC exposure, while options markets have turned notably defensive, with longer-dated skews entering positive territory for the first time since 2023, per K33. ETH futures, in contrast, are trading at a double-digit premium and have outpaced BTC since early August — fueled in part by substantial ETF inflows and corporate treasury accumulation. But as Ethereum's relative strength matures, traders are bracing for whether this cycle's script follows history or diverges entirely.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Latest News

Cointelegraph

Aug 28, 2025 06:44:06

Cointelegraph

Aug 28, 2025 06:35:09

CoinMarketCal

Aug 28, 2025 06:00:16

CoinMarketCal

Aug 28, 2025 06:00:16

CoinMarketCal

Aug 28, 2025 06:00:15