Binance stablecoin inflows top $1.6B, signaling traders positioning for rebound

Cointelegraph

Aug 27, 2025 04:35:56

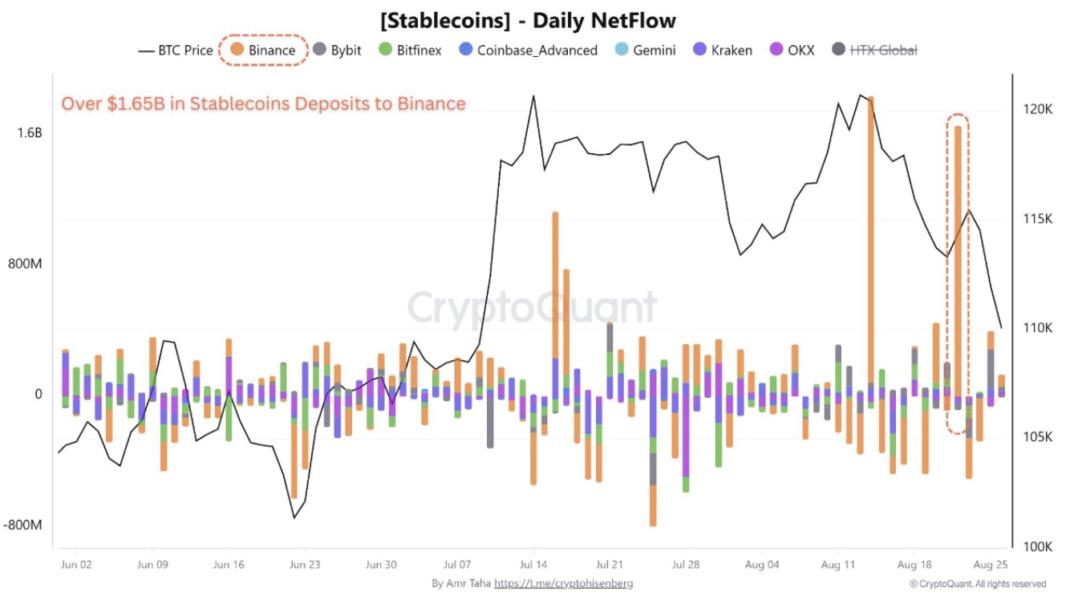

Users of the Binance cryptocurrency exchange deposited $1.65 billion in stablecoins, a large inflow often seen as a precursor to renewed demand for spot cryptocurrencies following the recent market sell-off.

The deposit coincided with nearly $1 billion in Ether withdrawals from Binance, according to onchain analytics provider CryptoQuant. It also marked the second time this month that net stablecoin deposits on the exchange exceeded $1.5 billion, “underscoring a renewed wave of capital entering the spot market,” wrote CryptoQuant’s Amr Taha.

Binance, the world’s largest cryptocurrency exchange by trading volume, is closely watched for signs of broader market shifts. On Tuesday, it processed more than $29.5 billion in trades, nearly six times the volume handled by runner-up Bybit, according to CoinMarketCap.

Stablecoins are the primary funding source for cryptocurrency traders, and their movement onto exchanges typically signals readiness to purchase digital assets.

The timing was notable on Tuesday, as crypto markets extended their early-week slump: Bitcoin and Ether gave back Friday’s gains, which had been fueled by comments from Federal Reserve Chair Jerome Powell signaling readiness to cut interest rates in September.

The recent market turbulence stemmed from a wave of long Bitcoin liquidations after a major sell-off over the weekend, when a whale offloaded 24,000 BTC on Sunday, sparking heavy selling pressure.

The BTC price briefly dipped below $109,000 on Tuesday, according to TradingView data.

Biggest Bitcoin-M2 divergence in two years

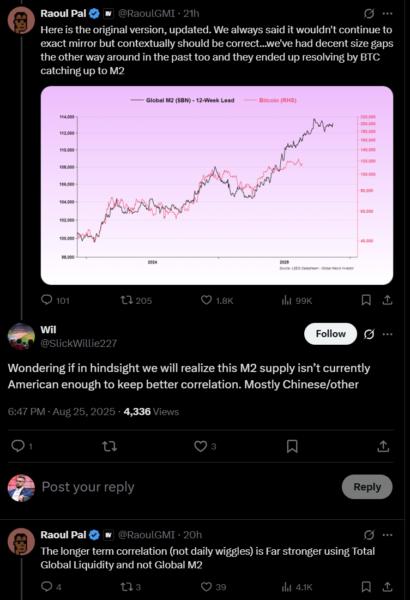

Bitcoin’s early-week slump stood out as it marked the sharpest deviation in two years from its typically close alignment with the global M2 money supply — a key measure of broad money circulating in the economy.

Since the pandemic, Bitcoin has shown a strong correlation with global M2, usually with a two- to three-month lag, providing traders with a relatively reliable guide to short-term price trends.

That said, as Real Vision founder Raoul Pal — one of the first to highlight the relationship — noted, the longer-term correlation is stronger when measured against total global liquidity, rather than M2 alone.

Another driver of Bitcoin’s recent volatility has been the steady outflow from US spot exchange-traded funds (ETFs). According to CoinShares, Bitcoin ETFs recorded over $1 billion in outflows last week.

The silver lining came on Monday, when the products saw their first day of net inflows in six sessions.

Latest News

The Block

Aug 27, 2025 11:54:41

Cointelegraph

Aug 27, 2025 11:20:47

CryptoPotato

Aug 27, 2025 11:14:53

Cointelegraph

Aug 27, 2025 11:09:15

The Block

Aug 27, 2025 10:54:38